student loan debt relief tax credit program for tax year 2021

The program typically takes 24 to 48 months depending on the amount of your debt and the agreement on the settlement. One form of relief came through the suspension of payments on federal loans held by the Department of Education.

Student Loan Forgiveness In Canada Loans Canada

It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators.

. In addition the department officials floated the possibility of a June 30 2022 cut-off for any loan forgiveness program requiring loans to. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the recipient must. Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness.

If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. Under the Consolidated Appropriations Act 2021 CAA 2021 Congress provided both financial assistance and tax relief. Complete the Student Loan Debt Relief Tax Credit application.

Michigan State Loan Repayment Program. About the Company 2021 Student Loan Debt Relief Tax Credit Information. From July 1 2022 through September 15 2022.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The suspension period was originally set to apply from March 13 2020 to Sept.

CuraDebt is a debt relief company from Hollywood Florida. If you are looking for some help 17. CuraDebt is a debt relief company from Hollywood Florida.

For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Repays up to 300000 of student loan debt in tax-free funds over a period of up to 10 years for eligible dentists doctors and mental health care professionals.

For unprotected financial debts such as charge card personal finances particular exclusive student loans or other comparable a debt relief program might give you the service you need. About the Company Tax Relief On Student Loans. The Student Loan Debt Relief Tax Credit Program for Tax Year 2021 is open for applications through Sept.

Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us. About the Company Is There Any Federal Tax Relief For Student Loan Payments. Open from Jun 30 2022 at 1159 pm EDT to Sep 15 2022 at 1159 pm EDT.

Ad Explore exclusive scholarships in New York to forgive student debt. Unfortunately for most unsuspecting. It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and accredited with the International Association of Professional Debt Arbitrators.

About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021 CuraDebt is an organization that deals with debt relief in Hollywood Florida. Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit.

It was established in 2000 and has been an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Child and Dependent Care Credit maximum value and phaseout threshold Lifetime Learning Credit and American Opportunity Credit maximum value and phaseout threshold Student loan interest deduction maximum deduction The bill would also extend the sunset date for the 10000 cap on SALT deductions currently end-of-year 2025 by one year.

If youre married your spouses income or loan debt will be considered only if you file a joint tax return or you choose to repay your Direct Loans jointly 18. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. The massive year-end package including tax provisions which effectively told Treasury Department and IRS to give debtors a break is welcome relief to many individuals and organizations.

It was founded in 2000 and is a participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie. Students at all education levels will be considered for the 25k Loan Forgiveness Grant.

See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program. Participants must work full time at a nonprofit health clinic for a minimum of two years to qualify. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better.

FAQ How To Get Student Loan Debt Relief Tax Credit 2021 In Turbotax How long does it take to complete the program. From July 1 2021 through September 15 2021. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. When setting up your online account do not enter a temporary email address such as a workplace or college email. Financial debts can have built up for countless reasons such as an unfavorable hardship overspending separation or other issues.

If you already have.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

10 Grants To Pay Off Your Student Loans Faster Student Loan Planner Student Loans Paying Off Student Loans International Student Loans

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Can I Get A Student Loan Tax Deduction The Turbotax Blog

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

If You Didn T Receive A Payment Here Are Some Ways You Can Qualify For The Credit In 2021 Taxes Stimulus New Baby Products Take Care Of Yourself Payment

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

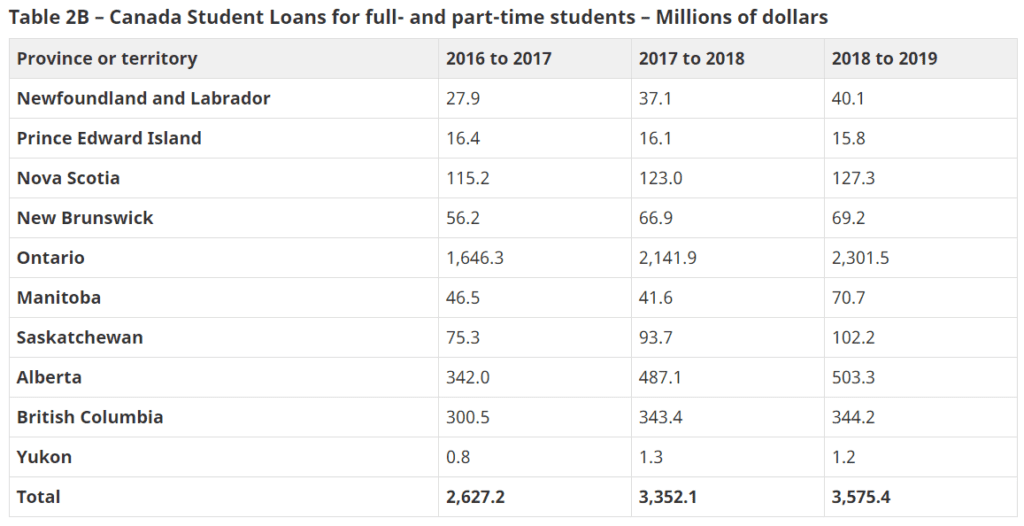

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness In Canada Loans Canada

The Government Can Help You With Your Student Loans Find Out How Student Loans Student Loan Repayment Student Loan Debt

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

Editable Balance And Income Statement Income Statement Balance Sheet Editable Documents Accounting Financial Statements Editable Template

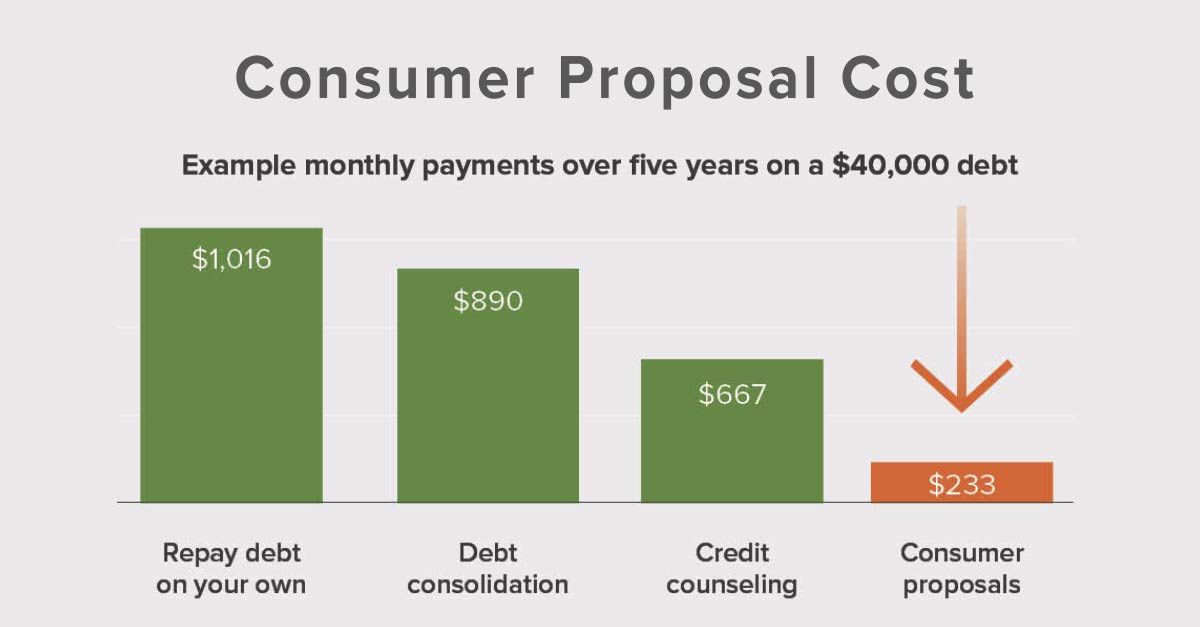

What Is A Consumer Proposal And How Does It Provide Debt Relief Hoyes Michalos

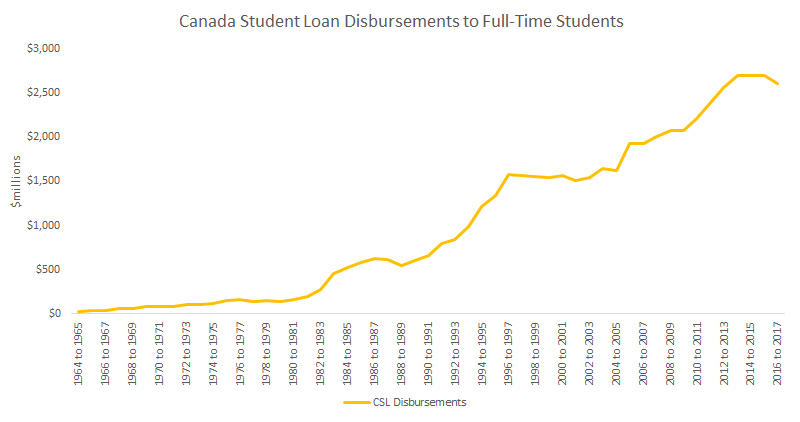

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca